This article goes back to basics and explores how you can ensure that your information systems support your firm’s decisions to improve profitability.

Introduction

I am often asked to implement an analytics solution to solve a whole multitude of issues, with a lack of insight from data; lack of accessibility to data; and a lack of trust in information being the top of most lists.

The concept of ‘business intelligence’ is not a new one. IBM’s Hans Peter Luhn was one of the earliest proponents back in 1958. Over time, the availability of technology has grown exponentially, and yet many firms still struggle to support key decisions with facts. These firms have (at least) one thing in common – they have a very poorly defined information strategy. This article explains why an information strategy is a critical component of improving profitability of a firm.

Q1. Do you use your practice management system for management reporting?

1. Your practice management system is not designed for reporting

A common misconception when a firm implements a Practice Management System (PMS) is that the solution will provide an answer to almost everything. The PMS is in fact designed to manage workflows and transactions. It was not designed to be a reporting engine. PMS data is often accessed by aggregating line item data power hungry SQL queries, which has a significant impact on the performance of the PMS.

2. Do not confuse operational reporting with management reporting

Can you make a decision on it? Yes, then its management information (MI). If not, then it is operational information (OI). The latter is often used to check the status of matters, review time data for billings, etc. It is not aggregated into anything meaningful. Nor does it require information in context, which needs to be provided by multiple sources (e.g., CRM and HR).

MI helps you make better decisions. Therefore, different types of information need to be presented together in context. For example, if you want to understand expected billing performance, you need your pipeline data from your Client Relationship Management System (CRM), alongside YTD fees billed from your PMS.

Why is this important? The requirements for delivering MI are different to OI, and it is not easy to design a single reporting system (including the underling infrastructure), to do both.

3. Where do you keep the data?

PMS was not designed as a single repository of the firm’s information. Do you really need to create custom fields to hold data from your CRM system? Or do you really need to add new tables to hold employee data? Why? The data already exists in the source system. The PMS is a very poor data aggregator. Also, the more data fields you add, the slower it gets.

4. Modern BI solutions can access data from more than one place

You no longer need a single feed from a PMS to prepare a management report, you can blend data from multiple sources within most BI tools. For larger data sets, this is usually done through a data warehouse, or a data lake. For management information, this data warehouse is an extract of only critical information required to support decisions. This lean and lightweight design ensures that the performance is optimised, without impacting the transaction systems.

Also, gone are the days of printed tables with static information. Modern BI solutions allow you to identify and drill down to explore what has been happening with just a few clicks.

5. The volume of management information is small

The volume of data now available to decision-makers is forever increasing, the time available to absorb the data is diminishing. Therefore, best practice is to keep the firm’s report inventory to an absolute minimum, rather than create every permutation possible. I have previously written about the reporting journey.

Q2. Do you capture the data that you need?

Most firms have a portfolio of information systems projects on going. An information strategy helps ensure that these projects are working towards delivering the information that the firm’s decision makers really need.

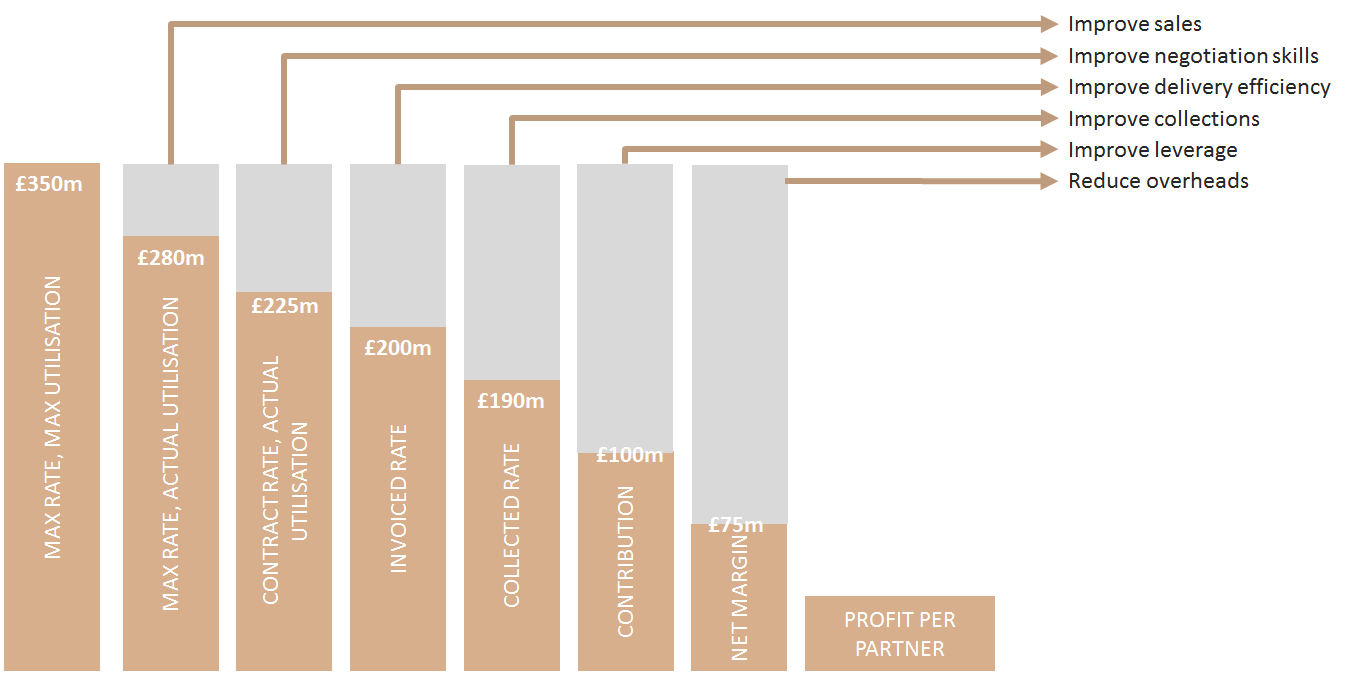

Alfred Rappaport’s work in the 1980s defined the concept of shareholder value, and much research has gone into defining the ‘value drivers’ which lead to improved shareholder value. These value drivers are actions that a firm can take, which lead to increased shareholder returns. A measure is then assigned next to each of these actions to monitor progress. This concept can be adapted for the legal sector through the concept of ‘value leakage’.

In this example, there is a £25m loss of value between agreeing a contract price with the client and the value that was actually invoiced, i.e., a recovery rate of 90%. Do you capture reason codes for the time write off? This type of analysis will allow you to take action, if for example you had a higher proportion of supervision time in some areas of your firm

An information strategy designed around the value drivers allows you to understand what data you need to capture to support critical decisions, and prioritise future systems development activities. In my experience, this often gets overlooked. As a consequence, the firm’s information systems do not provide information that is aligned with information strategy, and major areas of information requirements are missing.

Therefore, my final words on this topic…before undertaking any systems development, think about what decisions you need to take on a daily basis, monthly basis, annual basis (etc.) and define what information you need to support those decisions.

Tanbir Jasimuddin

Senior Validatum® Pricing Analyst and Data Scientist

M: 07796 268 769